• Up slightly for the week

The property sector rebounded last week with the KL Property Index

gaining 1.8%. Selective buying was seen in large cap property investment companies such as KLCC and IGB, as well as UEM Land, IJM Land, Sunway City and Mah Sing. On major shareholding changes, Employees Provident Fund (EPF) acquired 1.1m shares in SP Setia last week, Tong Kooi Ong acquired 0.3m shares in Sunrise, and Aberdeen Asset Management and Dato’ Dr Yu Kuan Chon acquired 0.4m and 0.1m shares in YNH Property respectively.

• Notable property news

Last week, Naim Holdings announced plans to partner Cahya Mata Sarawak Bhd (CMS) and Bintulu Development Authority (BDA) to build a RM1.5bn township in Samalaju, Sarawak, which will cater for the expected boom in the working population in the Samalaju Industrial Park located 80km north of Bintulu. The new township, covering an area in excess of 2,200ha, will be developed over 10 years. Naim will hold 60% of the tie-up, with CMS having 30% and BDA the balance. Another major development announced last week was the redevelopment of the Sungai Besi Royal Malaysian Air Force (RMAF) base which was purportedly agreed in principle by the cabinet. According to sources, a consortium comprising 1Malaysia Development Bhd (1MDB), Lembaga Tabung Angkatan Tentera (LTAT) and Datuk Desmond Lim of Malton Bhd, will be developing the 162 hectare site into a multi-billion ringgit Islamic financial centre. It is said that 1MDB would hold 30% interest while Lim or Malton would hold 40% and LTAT the remaining 30%. Up north in Penang, Plenitude acquired a piece of land in Batu Ferringhi for RM45m The company said the land measures about 165,000 sq m and the transaction costs about RM273 sq m or RM25 sq ft. The company plans to develop medium-high end, semi-Ds houses and condominiums on that site.

• Maintain OVERWEIGHT

We remain bullish on the residential sub-segment of the property sector, as we believe investors’ concern on the impact of interest rate hike has been overblown. We hold the view that interest rate hike will be gradual and minimal. Further to that, property sales is driven more by sentiment, which remains buoyant, rather than interest rate alone. We like the residential sub-segment on expectation of higher sales in CY2010 amid still low interest rate and improving sentiments. We see little upside in big cap property stocks and as such prefer laggard mid-cap property stocks such as Sunway City and Sunrise. Among non-rated property stocks, we like Mah Sing.

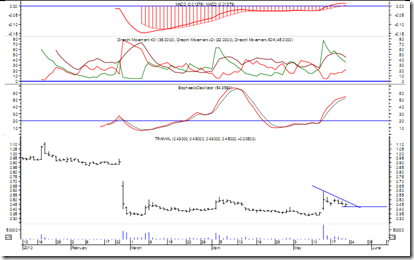

above: click to enlarge

above: click to enlarge

by ECM Libra

![75px-Siemens_Martin_Ofen_Brandenburg[1] 75px-Siemens_Martin_Ofen_Brandenburg[1]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEg78oQPidhfIe6udnFhI-WVs1h_T6MGfxKDaG9Ebj1_PbCNF6BvArwb_6dVEoaTEOTrKXLJa2MaWxAJ0uNCSotucQTRFGd_Q-RtuRtxLoLbTvzXO-4EROLZ4YckE3bg8NKI_zadoEZW2M1x/?imgmax=800)

• Lower amid market consolidation

• Lower amid market consolidation

For the property sector, demand should be supported by an improving economic outlook, rising income levels, inflationary fears (property is perceived as a good hedge against inflation), and a young population (50% below 21 years of age). The mass residential segment should still be supported as those who need to buy properties would still do so. Our top property pick is SP Setia (TP: RM4.80).

For the property sector, demand should be supported by an improving economic outlook, rising income levels, inflationary fears (property is perceived as a good hedge against inflation), and a young population (50% below 21 years of age). The mass residential segment should still be supported as those who need to buy properties would still do so. Our top property pick is SP Setia (TP: RM4.80).

Our target price for Kencana remains unchanged at RM2.04 based on a calendarised PER of 16x FY11 EPS

Our target price for Kencana remains unchanged at RM2.04 based on a calendarised PER of 16x FY11 EPS