Current price: RM8.75 Maintain Buy, RM10.60 Target Price.

Sustainable high dividends

• Strong transaction banking franchise will support non-interest income and ROE

• Domestic engines buzzing; regional growth cranking up

• Maintain Buy rating and RM10.60 TP; top pick for Malaysian banks

Less susceptible to capital market volatility. MAY’s strength is recurring fee income from its strong transaction banking segment. It is less susceptible to capital market weakness as over 50% of its non-interest income is recurring, mainly from transaction banking activities. MAY has an advantage, by leveraging on deposit franchise for transactional banking given its high CASA base (36% of total deposits; 42% for domestic (Malaysia-only) portion).

The inclusion of Kim Eng should raise investment banking income to 8% of total revenue (from 2%), by leveraging on its local capabilities and Kim Eng’s franchise. Key risks are integration and execution of mandates, which depend on market conditions.

Growth intact. Singapore and Indonesian operations remain strong - loans grew 44.6% and 28.8% y-o-y, and contributed 14% and 6% to MAY’s pre-tax profit, respectively. 2012 KPIs include 15.6% ROE, 16.2% loan growth and 11.6% deposit growth. Integrated 5-year regional road map could see cost-to-income ratio being sticky in the near term.

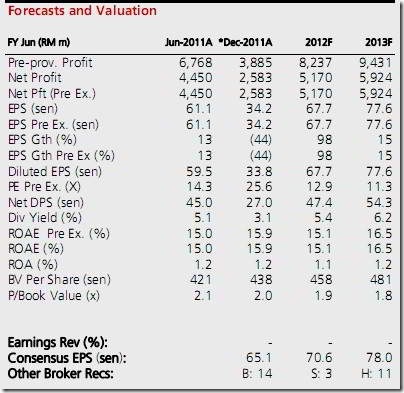

Maintain Buy, RM10.60 TP. We like MAY as a defensive play. It offers the highest dividend yield in the sector. Our RM10.60 TP implies 2.3x FY12 BV, and is based on the Gordon Growth Model with 16% ROE, 7% growth and

10.8% cost of equity. MAY’s dividend yield is appealing at c.6%, assuming sustainable 70% payout ratio. It declared 36sen DPS (32sen applicable for DRP) for FY11, implying 80% net payout. The high payout is likely sustainable as we expect MAY to utilise its existing S108 tax credit

(RM1.95bn) before it expires in 2013.

by DBS Vickers Securities