KARYON – MYR0.385 SHORT-TERM BUY (TECHNICAL)

Karyon Weekly Chart (click to enlarge):

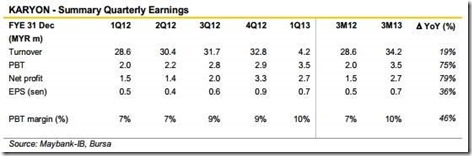

For the quarter ended 31 Mar 2013, the group recorded revenue of MYR34.2m, a rise of 19.4% compared to the corresponding quarter last year. The higher revenue was attributed to the growth in sales volume coupled with higher selling prices for polymeric products. KARYON’s polymetric division saw higher sales volumes and

profit margins while its oleochemical division was weaker due to a slight decrease in selling prices despite the higher sales volume. KARYON was recently promoted to the Main Board of the KLSE from the Ace Market that it used to be trading in.

Moving forward, KARYON will continue to focus on improving its operating efficiencies. Maybank-IB has no fundamental coverage on KARYON. A check of Bloomberg consensus reveals that there are no other research houses that have coverage on the stock. KARYON is currently trading at a historical PER of 13.3x with a high indicative dividend yield of 4.06%.

Karyon Industries Berhad (KARYON), through its subsidiaries, manufactures and trades PVC, chemical, lastic and industrial products as well as manufactures foam boosters, concentrated detergent paste, washing detergent, and shampoos

by Maybank IB