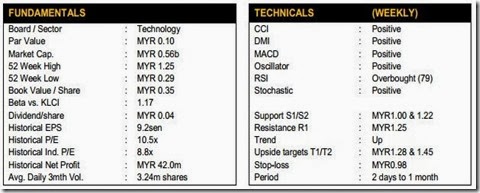

INARI – MYR1.22 Stock Code: 0166 (Bloomberg Code: INRI MK Equity)

INARI made a major weekly Wave 2 low of MYR0.37 (Mar 2013) with grossly oversold and bullish signals. All its positive signals above suggest a strong daily Wave 3 and 5 uptrend. It is likely to break into higher territory, as it breached its key resistance areas in a clear upward Wave 3 and 5 move. Short-term BUY on dips for INARI, with very firm supports and clear upward target areas of MYR1.28, MYR1.45 and MYR1.80. Stop-loss is at MYR0.98.

INARI announced its 4QFY13 results in August. The group’s profitability rose significantly as revenue surged 61.9% YoY to MYR67.7m from MYR41.8m FY12] while profit before tax (PBT) rose 252.6% YoY to MYR13.4m from MYR3.8m over the same period. The strong rise in profitability was attributed to increased orders from the group’s major customer, resulting in greater utilisation of its production capacity. Other factors contributing to the significantly better bottom line were higher trading volume, favourable gold prices and a strengthening US Dollar.

Going forward, INARI expects rising dem and to contribute positively to its outlook, as demand for smart phones and tablet computers is expected to register double-digit growth in the near term. Furthermore, INARI expects that their recently completed acquisition the Amerton Group to contribute positively to its financial performance from FY14 onwards.

A check of Bloomberg consensus reveals that only one research house has coverage of the stock, with a BUY call. The stock is currently trading at a historical PER of 10.5x and P/BV of 3.5x. INARI has a good indicative 12-month dividend yield of 3.6%.

Inari Amertron Berhad (INARI)’s products and services include back-end wafer processing, package assembly, and RF final testing for the electronic and semiconductor industries. It also provides services for the wireless communications industry.

by Mayban IB