Malaysia Stock Market Strategy

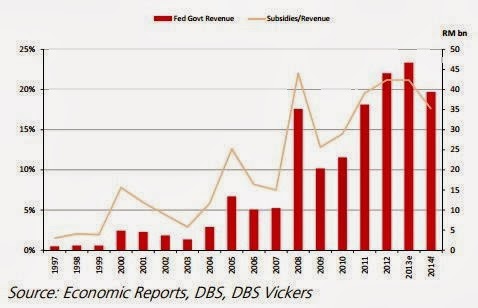

below: Government Subsidies Projected To Fall In 20014

Factors driving performance

Renewed risk appetite after tapering delay. The benchmark KLCI gained 2.8% in October, following renewed risk appetite for emerging markets with the delay in QE tapering. The UMNO election results indicatecontinuity within the party, with key incumbents retaining their positions. The Government introduced measures to narrow the fiscal deficit in the 2014 Budget. The KLCI lagged the MSCI APxJ’s 4.5% gain in October. However, YTD the KLCI is up 7.4% versus the MSCI’s 2.8% gain.

What to look for

Expect more subsidy reductions. Under the 2014 Budget, the Government projects subsidies to drop 16% (or RM7.3bn) from RM46.7bn in 2013. Subsidy for sugar (RM0.34/kg) will be removed. The reduction in overall subsidies is equivalent to 2.2x the full year savings from the lower fuel (RON95) subsidy (20 sen or RM3.3bn) in September. In addition, the Government will introduce the Goods and Services Tax (GST) in 2015 (at 6%) to widen the tax base.

Key themes

Subsidy rationalization, GST.The lower subsidies and GST will be implemented together with targeted cash assistance and lower corporate and personal taxes, but they could still weaken consumer spending and adversely affect Parkson (Hold) and Padini (Hold). However, Bursa Malaysia (Buy) could be a beneficiary if GST replaces stamp duty for share trading. Although not stated in the Budget, the subsidy rationalization is likely to involve energy prices; a fuel cost pass-through mechanism would be positive for Tenaga (Buy).

Ample construction activity. The West Coast Expressway (WCE) will be implemented, as mentioned in the 2014 Budget, allaying worries that it would be delayed. The commitment for WCE is certainly positive for IJM Corp (Buy). The next milestone is the announcement of achieving financial close. We look for IJM to clinch c. RM3-4bn out of the RM5bn worth of infrastructure works.The Gemas-Johor Baru double tracking or southern double tracking will also continue. This is

positive for Gamuda (Buy). WCT (Buy) could benefit from the upgrading of East Malaysian airports.

Property: More headwinds? Higher Real Property Gains Tax (RPGT) and removal of Developer Interest Bearing Schemes (DIBS) could dampen sentiment towards the property sector. We do not discount the possibility of more restrictions in Johor, including higher processing fee of 4-5% of property value and disallowing foreigners from buying from locals in the secondary market. Developers with large exposure to high-end condos in Iskandar Malaysia will be the most vulnerable (Iskandar Waterfront/Tebrau Teguh, Tropicana). Landed mass housing (Crescendo, Daiman, KSL) should still see resilient demand from locals. Developers with large exposure to Iskandar Malaysia such as UEM Land and Sunway may also be affected by softer overall demand.

Stock Picks

Buy

Bursa Malaysia (Share price: RM8.04; TP: RM10.10)

Potential for structural changes in fees and costs. Implementation of GST could be an opportunity to spur retail participation.

IJM Corp (Share price: RM5.80; TP: RM7.20)

Poised to benefit from construction of West Coast Expressway.

TSH Resources (Share price: RM2.52; TP: RM3.00)

On the cusp of exponential growth trajectory, underpinned by its explosive FFB volume growth. Cheapest plantation stock in DBSV Malaysia universe.

Fully Valued

Axiata (Share price: RM6.87; TP: RM5.75)

Margin compression at XL Axiata.

Maxis (Share price: RM7.19; TP 5.65)

Trading at highest PE in the sector. Market share may moderate with intensifying competition.

MAS (Share price: RM0.34; TP: 0.30)

Yields under pressure due to competition from regional and domestic carriers.

By DBS Vickers (1st Nov 2013)