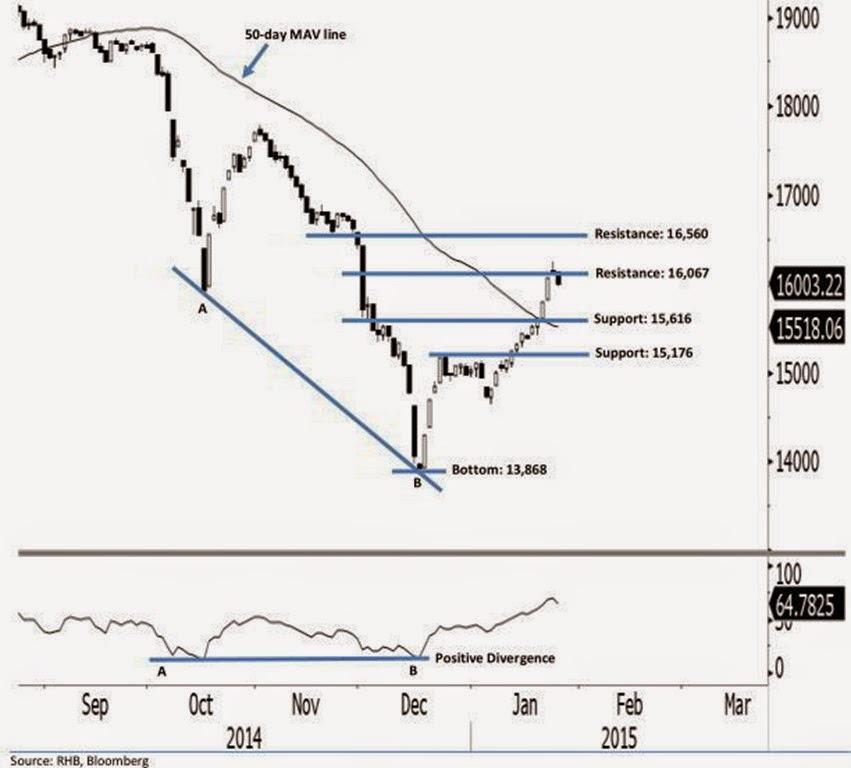

FBMSC Index: Technical Analysis

Current outlook is still positive. After breaching and closing above the 16,067-pt level on 23 Jan, the FBMSC was seen as weak yesterday as it plunged and closed below that level. It opened at 16,143.93 pts and settled lower at 16,978.55 pts, recording a total decline of 132.90 pts at the end of the day. We saw a black candle being printed, suggesting that the session was in a rather bearish mode. However, we regard the breather as a normal reaction, after the five consecutive upward movements from 19 to 23 Jan. Overall, we opine that the bullish momentum is still intact, and may resume again after the breather ends.

The breather might only be temporary, as we note that there is a high chance for the FBMSC to progress upwards due to the appearance of the “Positive Divergence” signal on the daily RSI indicator. In addition, the index has been recovering gradually since it rebounded firmly on 17 Dec last year. Thus, we believe that the bullish momentum has returned, implying that the previous near-term retracement may have reached its end. With the entire positive development observed so far, it is likely that the FBMSC has found its bottom at the 13,868-pt low recorded on 16 Dec 2014.

Our immediate support level is now at 15,616 pts, ie the candle’s low on 2 Dec 2014, while the critical support is at the 15,176-pt mark, ie the high of 23 Dec 2014. On the flip side, the immediate resistance is at 16,067, which was the middle of 1 Dec 2014’s session. This is followed by the critical resistance at the 16,560-pt threshold, seen at the low of 21 Nov 2014.

by RHB Research