RM1.07 Fair value: RM1.79 Stock Code: 5259

INVESTMENT HIGHLIGHTS.

• Incorporated in 1993, E.A. Technique (M) Bhd (Eatech) is a ship owner and operator of marine vessels, providing O&G port transportation services.

• Incorporated in 1993, E.A. Technique (M) Bhd (Eatech) is a ship owner and operator of marine vessels, providing O&G port transportation services.

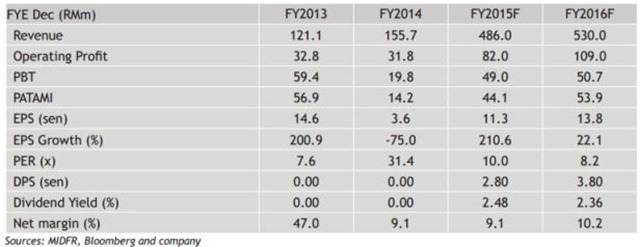

• Earnings is set to triple from RM14m in FY14 to RM44m in FY15F and RM54min FY16F underpinned by maiden contribution from the Engineering, Procurement, Construction, Installation and Commissioning (EPCIC) segment, entailing a floating storage and offloading facility (FSO) for a Full-Field Development Project in the North Malay Basin secured end of last year. The project is worth USD191m and is estimated to be delivered in August 2016.

• Its core business in marine transportation, offshore storage of O&G and port marine services (contributes to >50% of earnings) is expected to be driven by the addition of 7 vessels, all backed by secure contracts (3 to 6 years).

• Upon completion of its dry dock by mid-2016, (which will cater to in-house vessels), Eatech should be able to reduce maintenance costs and improve margins. The dry dock could catalyse a new source of revenue if plans to open it up to third parties materialise.

• Incorporated in 1993, E.A. Technique (M) Bhd (Eatech) is a ship owner and operator of marine vessels, providing O&G port transportation services.

• Incorporated in 1993, E.A. Technique (M) Bhd (Eatech) is a ship owner and operator of marine vessels, providing O&G port transportation services. • Earnings is set to triple from RM14m in FY14 to RM44m in FY15F and RM54min FY16F underpinned by maiden contribution from the Engineering, Procurement, Construction, Installation and Commissioning (EPCIC) segment, entailing a floating storage and offloading facility (FSO) for a Full-Field Development Project in the North Malay Basin secured end of last year. The project is worth USD191m and is estimated to be delivered in August 2016.

• Its core business in marine transportation, offshore storage of O&G and port marine services (contributes to >50% of earnings) is expected to be driven by the addition of 7 vessels, all backed by secure contracts (3 to 6 years).

• Upon completion of its dry dock by mid-2016, (which will cater to in-house vessels), Eatech should be able to reduce maintenance costs and improve margins. The dry dock could catalyse a new source of revenue if plans to open it up to third parties materialise.

VALUATION

• Eatech has outperformed peers since its listing in 2014 with the share price rising by a whopping 190% YTD. Nonetheless, we see room for further re-rating given the potential job awards from its RM1bn tenderbook. We value Eatech at RM1.79 based on CY16 PER of 13x.

• Eatech has outperformed peers since its listing in 2014 with the share price rising by a whopping 190% YTD. Nonetheless, we see room for further re-rating given the potential job awards from its RM1bn tenderbook. We value Eatech at RM1.79 based on CY16 PER of 13x.

source: MIDf Research 12/01/16