CURRENT FBMKLCI: 1,668 TARGET END-16 FBMKLCI: 1,700

Not surprisingly, institutional investors we met in Singapore remained UNDERWEIGHT on Malaysia, citing a lack of catalysts. Nevertheless, there remains interest in infrastructure-related plays and exporters. Among the timely top picks are Genting Bhd and small-mid caps Bumi Armada, BIMB Holdings and WCT Holdings.

WHAT’S NEW

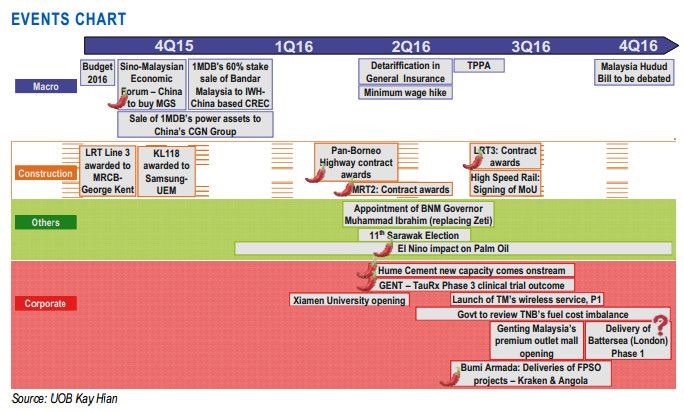

Malaysia’s appeal as a low-beta market. We recently met a handful of institutional fund managers in Singapore which are UNDERWEIGHT in Malaysia, citing the lack of catalysts. Nevertheless, there is: a) general agreement that the FBMKLCI would remain a low-beta market and hence outperform during a regional market downturn, and b) selective investment interests related to the key topics covered, such as politics (a potential general election in 2017, a potentially new political party set up by Tun Dr Mahathir), the impact of EPF setting up a Syariah fund in 2017, and investment ideas (infrastructure-related and export-oriented sectors, and stocks with potential event-catalysts such as Genting Bhd and Bumi Armada).

Of limited interests. It was interesting to note that there were little interests to discuss the US Justice Department’s action against the defrauders of 1MDB, indicating that the market has assumed that this event would not destabilise the country’s current political situation. This is consistent with our assessment of lower political risk premium in 2016 vs 2015, and that the ringgit would remain weak (end-16 target: RM4.15/US$). Also notable was the limited interest in high-yield plays in Malaysia.

ACTION

Maintaining our view that the FBMKLCI would remain in the doldrums in 3Q16 before trending up in 4Q16 to reach our end-16 target of 1,700, based on 15.8x 2017F PE, +0.7SD above historical mean PE. We still expect: a) the FBMKLCI to trade at a narrow range of 1,600-1,728, and b) small-mid caps to modestly outperform large caps (-3.0% ytd, 2H16-to-date: +1.2%).

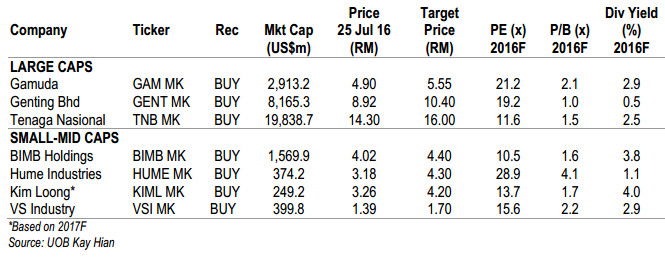

Our top picks include large caps Gamuda, Genting Bhd and Tenaga Nasional; and smaller caps BIMB Holdings, Hume Industries, Kim Loong Resources and VS Industry. BUY-rated stocks with near-term event catalyst include WCT Holdings and Bumi Armada, apart from Genting Bhd. However, following its 11.9% price run-up from the recent low, Genting Bhd’s share price could be swayed either way after 27 July when its 20%-owned Tau-Rx is scheduled to reveal the latest findings of its final clinical trial results in Alzheimer's Association International Conference 2016 (AAIC).

Meanwhile, maintain SELL on Hartalega, UMW and TM. Of these, Hartalega could be the most vulnerable in the near term as pricing and margins of nitrile gloves could have continued to slide in the past couple of months.

STOCK PICKS Malaysia’s appeal as a low-beta market. We recently met a handful of institutional fund managers in Singapore which are UNDERWEIGHT in Malaysia, citing the lack of catalysts. Nevertheless, there is: a) general agreement that the FBMKLCI would remain a low-beta market and hence outperform during a regional market downturn, and b) selective investment interests related to the key topics covered, such as politics (a potential general election in 2017, a potentially new political party set up by Tun Dr Mahathir), the impact of EPF setting up a Syariah fund in 2017, and investment ideas (infrastructure-related and export-oriented sectors, and stocks with potential event-catalysts such as Genting Bhd and Bumi Armada).

Of limited interests. It was interesting to note that there were little interests to discuss the US Justice Department’s action against the defrauders of 1MDB, indicating that the market has assumed that this event would not destabilise the country’s current political situation. This is consistent with our assessment of lower political risk premium in 2016 vs 2015, and that the ringgit would remain weak (end-16 target: RM4.15/US$). Also notable was the limited interest in high-yield plays in Malaysia.

ACTION

Maintaining our view that the FBMKLCI would remain in the doldrums in 3Q16 before trending up in 4Q16 to reach our end-16 target of 1,700, based on 15.8x 2017F PE, +0.7SD above historical mean PE. We still expect: a) the FBMKLCI to trade at a narrow range of 1,600-1,728, and b) small-mid caps to modestly outperform large caps (-3.0% ytd, 2H16-to-date: +1.2%).

Our top picks include large caps Gamuda, Genting Bhd and Tenaga Nasional; and smaller caps BIMB Holdings, Hume Industries, Kim Loong Resources and VS Industry. BUY-rated stocks with near-term event catalyst include WCT Holdings and Bumi Armada, apart from Genting Bhd. However, following its 11.9% price run-up from the recent low, Genting Bhd’s share price could be swayed either way after 27 July when its 20%-owned Tau-Rx is scheduled to reveal the latest findings of its final clinical trial results in Alzheimer's Association International Conference 2016 (AAIC).

Meanwhile, maintain SELL on Hartalega, UMW and TM. Of these, Hartalega could be the most vulnerable in the near term as pricing and margins of nitrile gloves could have continued to slide in the past couple of months.

ESSENTIALS Minimal impact on EPF’s creation of a syariah fund. Recall that the Employees Provident Fund (EPF) recently announced that contributors now have the option to switch from the existing savings scheme to one based on Islamic principles called Simpanan Syariah, which will be activated in 2017. The initial value of Simpanan Syariah is RM100b and once contributors opt for this fund, they cannot switch back to the conventional fund.

We maintain our view that EPF’s need to carve out up to RM100b of its funds (representing 15% of its fund size in 1Q16) would not force the conventional fund to immediately and materially re-jig its portfolio. Naturally, the carve-out process (which we label as “‘Post Split”) would force EPF to transfer a proportion of its syariah-compliant holdings (eg telecommunications and plantation stocks) into Simpanan Syariah, leaving the conventional fund with a higher weightage in banks. Nevertheless, as shown on our sensitivity analysis below (which assumes a market cap proportional transfer of syariah-compliant stocks into Simpanan Syariah), the conventional fund’s sector holdings post split (ie sector weightage to domestic equity holdings) would not drop materially for the generally syariah-compliant sectors, and the increase in weightage in banks would still remain well below the banking sector’s weightage in the FBMKLCI.

Nevertheless, the creation of Simpanan Syariah as well as the ongoing growth of syariah compliant funds, will benefit syariah-complaint stocks, which typically command scarcity premiums. Among syariah-compliant stocks, we like BIMB Holdings.

source: UOBKayHian (Singapore) research – 26/07/16