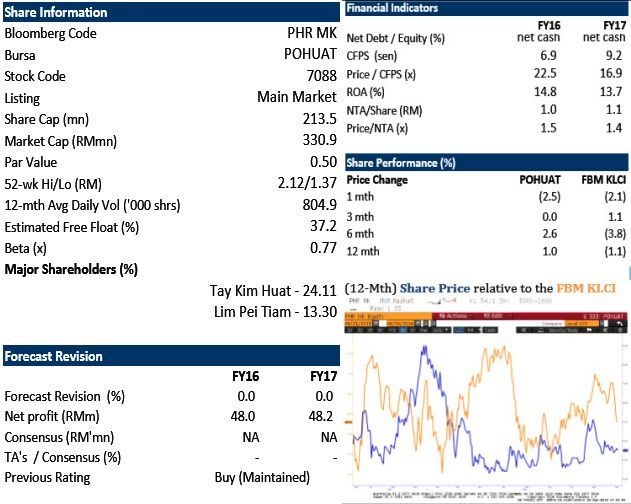

Expansion Down Under. Poh Huat Resources Holdings Bhd Stock Code: 7088

TP: RM2.05(+32.3%) Last traded: RM1.55

Expanding into Australia The company is acquiring a detached warehouse cum office-showroom in South Dandenong, Victoria, Australia, from JSNJ Investment Pty Ltd, for a total consideration of AUD4.25mn (RM13.27mn). The proposed acquisition will be funded by internally generated funds. This is backed by POHUAT’s net cash position of RM25.8mn as of end April 2016.

The property comprises a 2,807sqm single storey warehouse with a 315sqm office with retail/showroom facilities. It is situated on a 5,265sqm parcel of commercial land, secured by parameter fencing and automated gate entrance and has 47 car parks within its compound.

Dandenong is a suburb of Melbourne, approximately 30km South-East from Melbourne’s central business district. It is located within an industrial estate designated to host a cluster of “new economy” industry, including manufacturing, wholesaling, logistics and transport and storage business.

The rationale of the acquisition is to expand into new target market from its existing operational bases in Malaysia, Vietnam and South Africa.

The proposed acquisition is expected to complete by December 2016.

Our View We understand that for a start, the group intends to market its panel-based office furniture and bedroom sets under its own brand. While it may take some time to establish its brand and gain wide market acceptance, we are positive on the move as the new target market is expected to provide a growth potential to the group, and may in long term, reduce the over-reliance on the North America market.

Even though the population of Australia (estimated at 24mn as of 2015) is significantly smaller than its traditional main market in the US (estimated population of 320mn as of 2015), the Australia market is relatively untapped compared with the much more matured furniture business in the US. Furthermore, the product design adopted for the Western market in US market is commonly accepted by the Australians.

Forecast We leave our earnings forecasts unchanged for now. We do not expect the expansion to make immediate earnings contribution to the group in FY17 and FY18 as we think it may require time to establish the brand and gain market share.

Valuation No change to our target price of RM2.05, based on unchanged 10x CY17 EPS. Reiterate BUY call on POHUAT.

source: TA Secruties – 20/09/2016

POH HUAT RESOURCES HOLDINGS BHD

The principal activities of the Company are investment holdings and provision of management services. The principal activities of its subsidiary companies are manufacturing and trading of furniture and furniture parts.