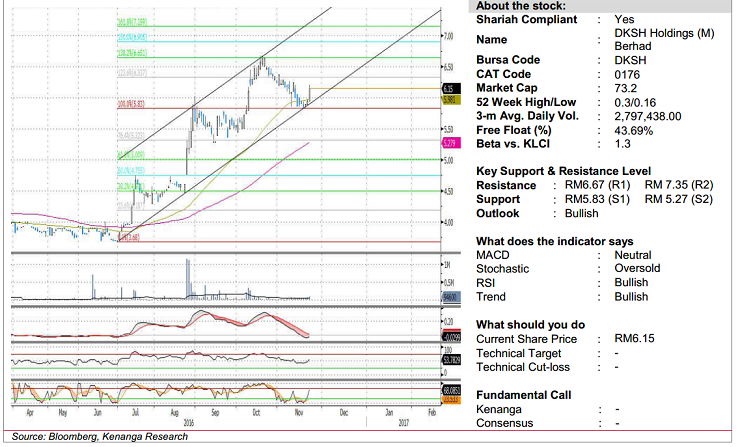

Yesterday, DKSH’s (Stock Code: 5908) share price rose 20.0 sen (3.4%) to RM6.15 on increased volume. DKSH is traditionally a thinly traded counter. However, liquidity has improved notably since the share price broke out of its sideways range in July (RM4.00). From then, the share price had also commenced a healthy uptrend to as high as RM6.67 just last month. More recently, the share price had pulled back to the uptrend support – providing investors with yet another opportunity to enter. With yesterday’s bullish move, the technical picture suggests that DKSH is poised for the next leg higher. We reckon that the share price is likely to stage a retest of the October's high of RM6.67 (R1) fairly soon. Should this level be taken out decisively, DKSH would then have a clear path towards RM7.35 (R2) further up. Downside support is RM5.83 (S1), below which investors may consider placing stops.

source: Kenanga Securities – 23/11/16

DKSH HOLDINGS (MALAYSIA) BERHAD

The Company is principally an investment holding company. The principal activities of the Group consist of general trading warehousing and distribution of consumer pharmaceutical bio-medical chemical and industrial products and also sale of Famous Amos chocolate chip cookies.