The upcoming general election could be a moderate market sway factor; 2H18’s market outlook would be cautious regardless of the outcome. While ruling coalition BN is set to retain the parliamentary majority in a three-way contest, there are still uncertainties relating to popular vote count and hotly-contested states. We expect the FBMKLCI to mildly trend up towards polling day, although the market remains divergent (amid deep profit-taking in small/mid caps).

WHAT’S NEW

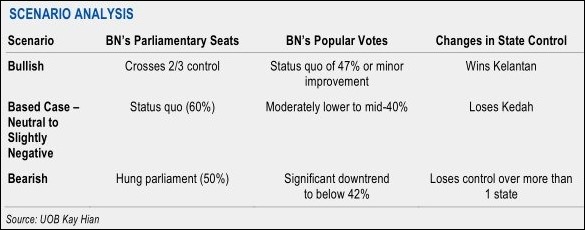

• Possibilities explored in GE14. The consensus is for Barisan Nasional ( BN) to retain its majority in parliament (albeit at a lower popular vote count) in the country’s 14 th general election (GE14), which is widely expected to take place in early-May 18. A big positive factor for BN is Pan-Malaysian Islamic Party’s (PAS) splinter from the main opposition coalition Pakatan Harapan (previously named Pakatan Rakyat), which creates a three-corner fight that opens up the possibilities of BN regaining a two-third majority in parliament (currently 59.9%) and regaining control of the states of Kelantan and Selangor. On the other hand, Pakatan Harapan is raising its challenges in BN’s incumbent states of Kedah, Johor and East Malaysia, boosted by the joining of former prime minister Tun Dr Mahathir Mohamad (who counts in his support sacked deputy prime minister Tan Sri Muhyiddin Yassin, a strongman in Johor). Meanwhile, sacked United Malays National Organisation (UMNO) vice president and Sabah strongman Datuk Seri Shafie Apdal formed a new opposition party, Sabah Heritage Party (WARISAN), in 2016.

• Mild uptick anticipated, but cautious environment post GE14. Despite the current caution, FBMKLCI should mildly firm up as we head towards the polling date, in line with most previous pre-GE market behaviour. However, expect more mixed performances in the small/mid-cap space, as investment sentiment has turned defensive much earlier than expected. Our base-case scenario of post-GE result reaction remains market neutral to slightly negative, and we continue to brace for a more subdued investment climate post GE14 particularly in 2H18 (although should the market continue to languish, there would be a temporarily rebound post-GE), as global liquidity contraction remains the over-riding issue. We maintain our end-18 FBMKLCI target of 1,830 which implies a forward PE of 15.3x (+0.4SD to the historical mean).

ACTION

• Valid GE plays. Although the current cautious investment sentiment implies fewer beneficiaries and shallower returns, our key GE14 beneficiaries identified should still deliver attractive stock returns – MRCB, Felda Global Ventures, KPJ Healthcare and Affin Bank. Other notable beneficiaries (although some are loosely linked to the theme) include some construction companies (eg Gabungan AQRS) and index heavyweights (particularly banks like CIMB).

• Top picks in this theme are BUY-rated large caps CIMB Group and Gamuda , and small/mid caps Cahya Mata Sarawak , Gabungan AQRS , and Protasco , and HOLD- rated MRCB . These stocks also offer upside post-GE

ESSENTIAL

• The journey towards GE14 has been accompanied by spectacular political news and developments, namely: a) the second sodomy charge and jailing of prominent Opposition leader Datuk Seri Anwar Ibrahim, b) revelation of massive corruption in the Ministry of Finance’s unit 1MDB (which gained international notoriety), c) sacking of prominent UMNO leaders who had criticised the 1MDB cover-up (Deputy Prime Minister Tan Sri Muhyiddin Yassin, Vice President Dato’ Seri Shafie Apdal and Kedah chief minister Dato’ Seri Mukhriz Mahathir) along with the country’s attorney general, d) management tussle at Federal Land Development Authority (Felda), and e) controversial reading of Hadi’s Bill (referring to PAS president Tuan Guru Dato' Seri Hadi Awang’s proposal which will empower states to implement Islamic laws). Meanwhile, Sarawak has set up state-owned oil and gas exploration firm Petros as part of its efforts to significantly raise its share of the state’s oil revenue (it currently receives only a 5% royalty).

• Base case: BN to maintain a simple majority in parliamentary seats... In our base- case scenario of a three-way fight between BN, Pakatan Harapan and PAS in Peninsular Malaysia, BN should maintain a simple majority of parliamentary seats (of around 60%). However, regaining a two-third control remains an uphill task, given the likelihood of slipping popular votes.

• …amid slipping popular votes. While the consensus view is for BN’s popular votes to slip a few percentage points (GE13: 47.4%), BN should maintain above the 40% commonly-thought threshold that would allow it to retain a simple majority in parliament. However, this situation is less certain in various state elections.

• Election factor a short-term sway phenomenon. While unexpected election results can be a significant market sway factor in the near term, such market reactions have been short-lived in the past. For example, when BN’s control of parliamentary seats surprisingly slipped below two-thirds during GE12, the FBMKLCI plunged by as much as 9.5% in a day, triggering a trading circuit breaker at the worst level. However, the FBMKLCI recouped most of the losses within a couple of weeks, once investors were assured of the continuity of political stability and business-friendly policies. Both BN and Pakatan Harapan are mindful of maintaining business-friendly policies; Pakatan Harapan has on various occasions highlighted that it will generally uphold the sanctity of government contracts should it win the election. Eventually, equity markets will be dictated by external and domestic economic fundamentals and liquidity considerations.

• Trading plays. GE14 beneficiaries should deliver attractive returns to government-linked companies Felda Global Ventures (FGV), KPJ Healthcare and Affin Bank (which interestingly has delivered good returns in most pre-polling periods). • Defensive BUY-rated stocks should gain prominence post GE14 . They include BUY- rated Berjaya Sports Toto , DiGi.Com, Petronas Dagangan, TM and Tenaga Nasional. FMCG companies continue to appeal as a safe haven, and among these, downtrodden BUY-rated BAT should appeal for its c.8% prospective yield. Likewise downtrodden Astro Malaysia (HOLD).

• Opportune time for long-term investors to accumulate selected mid caps. We feel the sell-offs related to global liquidity tightening, US-China trade war and GE fear factors are overdone for many mid caps (although we would generally avoid small caps). Although many of these stocks have still retained their past years’ huge capital returns even after the recent rundown, they continue to promise solid growth prospects through the intermediate term. Conviction stocks in this space continue to be Ann Joo Resources, Inari Amertron, and VS Industry.

source: UOBKayHian – 10/04/2018