Stocks on Bursa Malaysia closed higher last Friday fuelled by an improvement in external sentiment ahead of US Federal Reserve chair Janet Yellen's speech later of the day. Investors were optimistic that the world's largest economy would not raise interest rate soon despite the improvement in its economy. The ringgit firmed against the US dollar at 4.0130/0200 from 4.0150/0200 on Thursday on support from overnight rebound in crude oil prices. At close, the FBM KLCI added 2.79 points or 0.17% to 1,683.09 against Thursday’s close of 1,680.30. On a weekly basis, the key index fell 4.59 points from 1,687.68 on previous Friday. Gainers outpaced losers 441 to 360, while 378 counters were unchanged. Volume fell to 1.49 billion units worth RM1.39 billion from Thursday's 1.74 billion units worth RM1.89 billion. Weekly turnover decreased to 8.85 billion units worth RM8.26 billion from 13.31 billion units worth RM9.98 billion the previous week.

On the weekly chart, the FBM KLCI formed a Doji-like white spinning-top candlestick which indicates uncertainty of market direction with mild upward bias. Hence, the FBM KLCI may continue to stay in range-bound consolidation in the coming holiday-shortened week. On the daily chart, however, the FBM KLCI formed a bullish long white candlestick in a piercing-line position, a bottom reversal candlestick pattern, which indicates a fight back of the bulls after being beaten down for three consecutive sessions, and hence, the FBM KLCI may continue its rebound from last Friday to move higher today. Nevertheless, a confirmation of reversal will require the key index to close at least above the previous candlestick high of 1,687-points. Immediate overhead resistance zone is at 1,687 to 1,695 points, while the immediate downside support zone is at 1,675 to 1,666 points.

Weekly MACD continued to rise, and has crossed above the zero-line, indicating the medium term trend is turning bullish, and its histogram also extended higher, indicating continued gain in the weekly upward momentum. Daily MACD, however, continued to slide lower below the signal-line, but is still staying above the zero-line and its histogram also further extended southward, indicating further increase in the daily bearish momentum. Weekly RSI (14) hooked downward to 55.2 from 55.8, indicating a mild pullback correction on the weekly timeframe, and the weekly relative strength is still mildly bullish. Daily RSI (14) hooked upward to 55.6 from 53.8, indicating a mild technical rebound and the index’s daily relative strength is still mildly bullish. Weekly Stochastic hooked downward slightly to 87.2 from 88.3, indicating a mild pullback correction of the key index on the weekly timeframe, while daily Stochastic continued to slide lower to 51.8 from 57.3, indicating a continuation of the short term down cycle and further weakening of the key index. In short, mixed readings from the weekly indicators showed that the FBM KLCI is in a state of consolidation on the weekly timeframe; while readings from the daily indicators showed that the FBM KLCI is still in a correction mode despite the rebound on Friday.

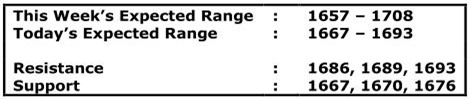

The near term trend of the FBM KLCI still remained down as the key index continued to stay below the 5, 10 and 15-day SMA, but is still staying above the short term 20 and 30-day SMA. The medium term trend of the FBM KLCI is still up as the key index continued to stay above the medium term 40, 50 and 60-day SMA, and all three moving averages are still pointing up. And the long term trend has turned sideways range-bound as most of the long term moving averages have turned flat with the 360-day SMA still pointing down. On a bigger picture, the FBM KLCI is still staying within the sideways channel (in blue) measured from the pivot low of 1,503-points, with a range of 1,600 to 1,730 points. In order for the FBM KLCI to turn bullish for the long term, the key index will have to break through the upper boundary of the sideways channel of 1,730-point. For the coming week, the FBM KLCI is likely to stay in range-bound consolidation within a range of 1,657 to 1,700 points while waiting for fresh catalysts to move the market for the holiday-shortened week.

Last Friday, the DJIA fell 53.01 points or -0.29% to close at 18,395.40. For the coming week, the FBMKLCI is likely to move within a range of 1,657 to 1,708, and today, the FBMKLCI is likely to move within a range of 1,667 to 1,693.

Trading stocks to watch:

29-8-2016: AMBANK, APPASIA, ASIAPLY, BJFOOD, BPLANT, CENSOF, CHINWEL, COMFORT, D&O, DANCO, DSONIC, ECONBHD, FRONTKN, GADANG, GENM, GKENT, KPS, MBMR, MITRA, MMCCORP, MMSV, NWP, OLDTOWN, PADINI, PRESTAR, SKPETRO, SMRT, TALIWRK, UOADEV, YEN

26-8-2016: AMBANK, ANNJOO, BJAUTO, BJTOTO, CAB, CSCENIC, DANCO, E&O, EITA, GASMSIA, HUAYANG, IGB, INARI, JAYCORP, LIENHOE, MAA, MAGNUM, MUHIBAH, OWG, PARAMON, REACH, SALCON, SAMCHEM, SKPETRO, TA, TGUAN, TITIJYA, UOADEV, VS, WILLOW, WONG

25-8-2016: AFFIN, ASUPREM, CMSB, CSCENIC, DANCO, DKSH, GENTING, GKENT, GTRONIC, HARTA, JTIASA, KSSC, KERJAYA, KRONO, MENANG, NWP, OKA, PARAMON, REACH, SAMCHEM, SBCCORP, STAR, UCHITEC, YINSON

24-8-2016: AEM, AEGB, AMBANK, APPASIA, AMEDIA, BTM, GKENT, JHM, KARYON, L&G, MAGNA, MALAKOF, MMCCORP, OLDTOWN, SERSOL, STAR, UCHITEC

23-8-2016: AEONCR, AFG, ASTRO, BERTAM, BPLANT, BTM, CEPAT, DNONCE, EFORCE, GOODWAY, HIL, IBHD, ILB, MAHSING, MRCB, MKH, NIHSIN, PASDEC, RSAWIT, SOP, SMRT, SPRITZER, SUNWAY, SYSTECH, UMSNGB, UNISEM, WONG, YEELEE, ZELAN

source: SJ Securities – 28/08/2016