..but share prices of Maxis and Digi did relatively well recently

Downside risks and vulnerabilities persist

● The Big 3 have released their 2Q16 results. Evidently, the irrational pricing on data has reduced the opportunity to monetise data in a profitable manner. While data consumption has increased by some 50% YoY, the Big 3's mobile service revenue dipped 11.9% in 1H16. Consequently, their EBITDA dipped 6.7% YoY.

● That being said, while fundamentals remain weak, the share prices of Maxis and Digi have outperformed the FBMKLCI index post Brexit/BNM's rate cut. We believe this could be largely attributable to the 'Shariah' and 'yield compression' factors.

● However, we still don't think that valuations are justifiable, given that fundamentals remain weak. Even if the spectrum fees for the 900MHz/1800MHz bands are not exorbitant, there is still more downside risk to the street's earnings estimates, as competition will likely intensify and there are more spectrum woes in 2017.

● We retain our UNDERWEIGHT rating on the sector. Suggested pairing: Long Axiata/Short Maxis and Digi. We retain our NEUTRAL rating on TM (earnings to remain flat in the medium term)

Poor 1H16 results…

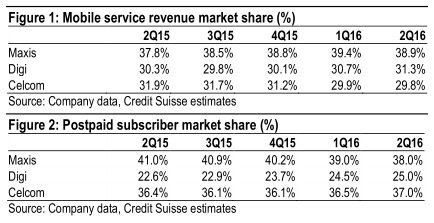

Both Digi and Axiata reported results that disappointed street estimates, while Maxis' results were in line. On a YoY basis, Celcom was the worst performer (1H16 mobile service revenue -11.9%) as the 'loss' of VAS revenue persisted in 2Q16. This resulted in Celcom losing 2.1% market share in 1H16 vs 1H15. While Digi's 1H16 mobile service revenue dipped 1.9% YoY, it gained 1.0% market share, while Maxis gained 1.1%, even when its 1H16 mobile service revenue dipped 1.6% YoY. The Big 3 retained their flat YoY service revenue guidance, but we think it will be tough to play catch up in 2H16, given that pricing on data remains weak, despite robust data consumption.

At the EBITDA level, the Big 3's normalised EBITDA was 6.8% lower YoY in 1H16. Maxis had the lowest decline (-1.4% YoY), while Digi and Celcom's dipped 7.9% YoY and 13.3% YoY, respectively.

..but share prices of Maxis and Digi did relatively well recently

The mobile operators continue to underperform the FBMKLCI index on a YTD basis but post-Brexit and BNM's rate cut, Maxis and Digi's share prices have outperformed the index (Axiata did not perform as well, given the poor earnings outlook). The share prices were also supported by the strong take-up rate for the Shariah Savings Fund, launched by the EPF recently (analyst Tan Ting Min wrote about this on 22 Aug 2016).

Back to reality: TM and UMobile need to gain market share

When we met UMobile recently, we understood from management that its intention to list is very well alive and that its shareholders will continue to fund the business. In order to do that, management will focus on: (1) subscriber market share, (2) revenue market share (targeting to double it to 10-12% from 5-6% currently), and (3) profitability (still EBITDA –ve in 2015). To achieve these targets, management intends to launch a nationwide marketing campaign next year, after the company has received 900MHz/1800MHz spectrum.

Given that TM will also need to gain market share during the same period, there is a risk of further earnings downgrade in 2017 as revenue and EBITDA growth prospects remain muted as the market is saturated. As a reminder, since Jan-16, the market has already lowered Axiata, Digi and Maxis' 2017E EPS forecasts by 16.7%, 13.0% and 11.4%, respectively. Also, even if the spectrum fees for the 900MHz/1800MHz bands are not exorbitant, there is still more

downside risk to the street's earnings estimates, and hence, dividends, as competition will intensify and there will still be payments for the 700MHz/2300MHz/2600MHz bands.

Maintain UNDERWEIGHT

In conclusion, we retain our UNDERWEIGHT stance on the sector and Axiata remains our top pick. While it will take time for Celcom's new management to turn the business around, it is the only company without a Malaysia-only mandate. Hence, we expect upside to the share price if XL Axiata and other op-companies deliver the results.

Other potential negatives include: (1) aggressive competition by other MVNOs, especially TuneTalk and Yes 4G, (2) a weaker MYR, and (3) high-than-expected spectrum fees.

source: Credit Suisse – 30/08/2016