Blue chips on the local stock market staged a mild rebound last week, encouraged by Abu Dhabi’s agreement to provide funds to prevent government owned Dubai World’s property arm from default, but lower liners stayed weak as market breadth remained negative due to weak retail participation.

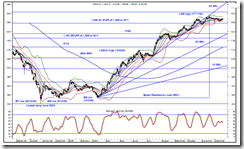

For the week, the FTSE Bursa Malaysia Kuala Lumpur Composite Index (FBM KLCI) rose 6.97 points, or 0.55% to close at 1,266.97, with gains on IOI Corp (+14sen), CIMB (+18sen), Genting Bhd (+19sen) and KLK (+52sen) representing almost all of the index’s rise. Daily average traded volume and value mildly slowed to 597.1mn shares worth RM863.9mn, compared with the 607mn shares and RM828.3mn average the previous week. (see the attached KLCI chart)

Spot month December KLCI futures contract traded on Bursa Malaysia Derivatives Berhad rebounded 4 points last week to close at 1,260, increasing the discount to the cash index to 6.97 points, compared to the 4-point discount the previous Friday.

Share prices reversed earlier losses on Monday to close higher led by selected blue chips, helped by regional gains after the Abu Dhabi government agreed to channel USD10bn to avert Dubai World’s property arm Nakheel PJSC from default. Stocks extended profit-taking consolidation the next day, in line with declines in the region on concern China will curb land speculation and the Australian dollar fell after the central bank damped expectation for higher loan rates. However, late buying in key heavyweights lifted the index to close positive.

The market extended range bound trade for the remaining two days, with most investors staying sidelined ahead of a three-day weekend holiday. Lower liners were mostly weaker as retail participation dwindled, discouraged by the negative market breadth for the four consecutive trading days.

The KLCI rose from low of 1,256.07 early Monday to peak at high of 1,272.59 early Thursday, expanding marginally to a 16.52-point trading range last week, compared with the 15.48-point trading range the previous week. Week-onweek, the FBM-EMAS Index was up 39.07 points, or 0.47% to close at 8,432.99, but the FBM-Small Cap Index retreated another 45.33 points, or 0.46% to 9,834.75.

The daily slow stochastics indicator for KLCI established another short-term sell signal following last Thursday’s dip (Chart 1), while the weekly indicator slid lower from the overbought region following a sell triggered the previous week. The 14-day Relative Strength Index (RSI) indicator dipped from the 60-point level for a reading of 52.88 last Thursday due to the late-week weakness, while the 14-week RSI retained a reading near the 70-point mark. source: TA securities

KLSE FBM KLCI analysis, Bursa Malaysia stock picks analysis and shares research.

Labels

Board: Ace

Board: Main

Bursa Malaysia / FBM KLCI Outlook

bursa malaysia outlook

Definition of Technical Ratings

Disclaimer

fbm klci

Industry Oil Gas Stocks

Industry Steel Stocks

Industry Telco Stocks

Industry: Automobile

Industry: Infrastrucuture

Industry: Timber

infrastructure projects

Sector Analysis

Sector Banking Stocks

Sector Construction Stocks

Sector Consumer Stocks

Sector Financial Stocks

Sector Industrial Products Stocks

Sector Plantation Stocks

Sector Property Stocks

Sector Technology Stocks

Sector Trading / Services Stocks

Sector/Industry IPC

Stock Picks Financial Analysis

Stock Picks Technical Analysis

stocks to watch

Warrant

Links

Copyright ©

Bursa Malaysia Stock Market Analysis Digest

| Our

Privacy Policy