Late window-dressing interest by certain local funds managed to lift index heavyweights higher on the final trading week for 2009, encouraged further by decent gains on global stock markets as trading ended for the year.

The FTSE Bursa Malaysia Kuala Lumpur Composite Index (FBM KLCI) gained 8.84 points, or 0.7% last week to close at 1,272.78, with gains on Public Bank (+32sen), Maybank (+6sen), IOI Corp (+6sen), AMMB (+13sen), Tenaga (+8sen) and KLK (+42sen) representing almost all of the index’s rise. Daily average traded volume and value improved somewhat to 555.9mn shares worth RM744.6mn, compared with the 429.4mn shares and RM678.3mn average the previous week.

Spot month December KLCI futures contract traded on Bursa Malaysia

Derivatives Berhad added another 2.5 points last week to expire at 1,266.5, reversing to a 6.28-point discount to the cash index, against the minor 0.06-point premium latched the previous week.

Bursa Malaysia shares brokeout from consolidation Monday, helped by regional and window-dressing gains which lifted the index to close at a two-week high.The next day stocks closed mildly higher on follow-through window-dressing gains, but the index spent most of the trading day in negative territory as buyers remained scarce.

On Wednesday, profit-taking emerged amid mixed regional markets damped by Moody’s negative ratings outlook for Hong Kong’s banking sector, and as investors locked in gains for the year. Nevertheless, blue chips bounced back to closed higher the next day, as late window-dressing lifted the index to close slightly up ahead of the New Year holiday.

The KLCI rose from intra-week low of 1.263.34 early Monday and spiked up to high of 1,275.29 early session the next day, shrinking marginally to a 11.95-point trading range last week, compared with the 12.07-point trading range the previous week.

Week-on-week, the FBM-EMAS Index rebounded 86.18 points, or 1.02% to close at 8,507.61, while the FBM-Small Cap Index surged 282.83 points, or 2.86% to 10,165.81.

The daily slow stochastics indicator for KLCI is poised to trigger a short-term sell signal (Chart 1), while the weekly indicator dipped further for a reading of 67.1. The 14-day Relative Strength Index (RSI) indicator hooked up for an improved reading of 56.81 last Thursday, while the 14-week RSI has re-hooked upwards with a reading of just above 70, which is the overbought line

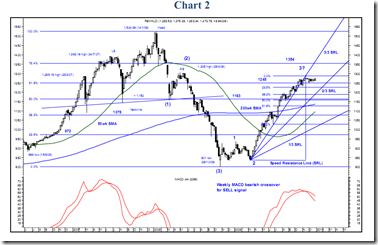

Meantime, the daily Moving Average Convergence Divergence (MACD)

indicator improved on its bullish trend reading, but the weekly MACD declined further to contrast the daily reading (Chart 2). As for the 14-day Directional Movement Index (DMI) trend indicator, the +DI and –DI lines contracted and are poised for a sell signal due to the pull-back from intra-day highs last week.

Conclusion

Technical momentum and trend indicators for the FBM KLCI continued to issue mixed signals as at the end of last year, but post window-dressing profit-taking and selling should dampen blue chip prices in the early part of this week.

However, if more robust buying momentum returns to offset the selling

pressure, stocks should bounce back by late week as domestic institutional funds re-enter the market on the more positive growth outlook for the first half of this year.