Genting Malaysia Hold (Share price: RM3.75 Target price: RM3.72)

Acquiring two companies from GENS

Business rationalisation. We do not expect Genting Malaysia’s (GENM) proposal to acquire two companies from subsidiaries of its sister company, Genting Singapore (GENS SP; Buy; TP: SGD2.06) for RM50m to negatively impact its share price being a business rationalisation decision. Furthermore, the consideration is small at only 2% of our FY11 net cash balance estimate and implies only 5.4x 2010 PER. Maintain Hold call and RM3.72 DCF based TP.

Small related party transaction. GENM entered into two sales and purchase agreements with Sedby Limited (Sedby) and Geremi Limited (Geremi) to acquire 100% of E-Genting and Ascend International for RM50m cash. Sedby and Geremi are 100% owned subsidiaries of GENS. In turn, GENS is a 52% owned subsidiary of Genting (GENT MK; Hold; TP: RM10.20). GENT also owns 49% of GENM. Valuations appear cheap. E-Genting is involved in the provision of IT services and consultancy, research in software development, and provision of loyalty programme management services. Ascend International is involved in investment holding, provision of IT services and marketing. Valuations wise, the RM50m purchase consideration implies an undemanding 5.4x 2010 PER and 2.1x 2010 P/BV.

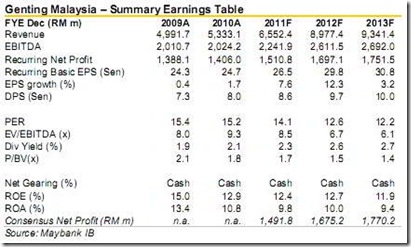

Maintain earnings estimates. The acquisitions are expected to be completed by 31 Oct 2011. On a full year basis, we expect both companies to contribute RM8.2m p.a. (RM9.2m net profit - RM1m interest income foregone assuming 2% interest rate) or <1% to our FY11 earnings estimate. Coupled with the RM50m purchase consideration comprising only 2% of our FY11 net cash balance estimate, we leave our earnings estimates unchanged.

Unlikely to negatively impact share price. Management explains that as some two thirds of the two companies’ customers are GENM’s rather than GENS’ customers, it is more rationale that both companies be parked at GENM rather than GENS. We concur and given that this related party transaction is small and to be transacted at low valuations,we do not expect it to negatively impact its share price.

by Maybank IB