FBM KLCI: OVERALL

• Slight dip in FBM KLCI consensus earnings. During the week ended 20 October 2013, current year FBM KLCI consensus EPS saw a minor week-on-week drop of -0.03 to 106.75. The weekly decline in current year EPS figure is attributable to slight downward adjustments in earnings of Banking and Plantation sectors (refer to Sectorial review below). Nonetheless, the FBM KLCI gained 13.84 points, a 0.78% rise, during the week to close at 1,799.59 and its current year PER ended higher at 16.86x.

FBM KLCI: SECTORIAL

• Telecommunication. The current year FBM KLCI–Telecommunication consensus EPS was unchanged week-onweek at 13.37. However, FBM KLCI–Telecommunication was up 1.08 point, 0.36%, to close at 301.23 during the week under review. The benchmark Telecommunication retains the highest valuation among the benchmark sectorial components as it ended the week with a current year PER of 22.54x.

ever higher valuation multiple is reflective of investors’ sanguinity with regard to its above average growth prospects which are driven by the positive outlook in the oil and gas sector.

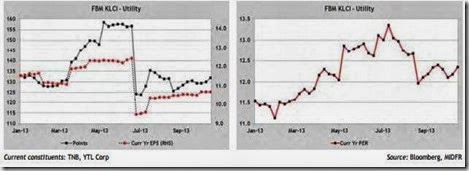

• Utility. For the week under review, the current year FBM KLCI–Utility consensus EPS was also unchanged at 10.69. The FBM KLCI–Utility nevertheless ended the week higher by 1.88 points, or 1.45%, to close at 131.95 and with current year PER of 12.35x. The FBM KLCI-Utility trades at a discount to the broad market valuation and has the lowest multiple among the benchmark sectorial components. It corresponds to the Utility stocks generally staid growth prospects but they are nonetheless good dividend payers.

FBM KLCI: BUDGET 2014

• Earnings, dividend, taxes and the equity market. The trajectory of equity market is principally hinged upon the expected performance of its corporate earnings. Furthermore, the valuation of equity price also bears a positive correlation to its net dividend payout. Hence reduction in either or both corporate and dividend tax rates should, ceteris paribus, provide a good fillip to the local equity market. On the government’s end, the initial income shortfall may later on be well compensated by higher corporate investments and thus bigger taxable earnings and dividends.

• Commitment to PFR may arguably be the key to preserve investors’ confidence. But however, the present fiscal reality affords the government little latitude to forgo present income for future higher revenue, the basic construct of our wish list in above. Not now, as the government is running on the deficit and its debt level is already on the brink of the 55% self-imposed ceiling. And more importantly, the international rating agency is breathing down its neck, so to speak. Therefore the urgency, present and now, is to retain Malaysia’s sovereign rating and preserve global investor confidence on the country with judicious implementation of the public finance reform (PFR) initiatives. Thus we reckon, under current scenario, an unflinching commitment (with affirmed timelines) by the government to fiscal consolidation, as per the PFR initiatives, may turn out to be the

key to continue winning investors’ heart.

• Reiterate our 2013 and 2014 year-end targets.Hence we expect slower domestic demand growth for next year but compensated by improvement in external performance. We reiterate our FBM KLCI year-end targets for 2013 and 2014 at 1,800 and 1,900 points respectively.

by MIDF