Expecting pent-up demand for GST-compliant software

HIGHLIGHTS

• Slow take-up in GST registration and implementation despite government incentive of RM1,000

• Government has reiterated that there will be no deferment in implementation of GST

• Potential market size for GST-compliant software in Malaysia is approximately RM1.7b

• Listed companies which provide GST-compliant software expected to record bump in sales for the period 4QCY14 and/or 1QCY15

Slow take-up in goods and services tax (GST) registration. Despite the application deadline is drawing near, we are of the view that businesses do not seem to be in a hurry to register for the eventual implementation of the GST scheme. It has come to our understanding that only 5%* or 15,000 out of the estimated 300,000 companies have registered with the Royal Malaysian Customs Department (RMCD) for the implementation of GST. Of the companies which have registered, 80% are from the small and medium-enterprise (SME) segment. Nonetheless, various media sources indicated that the government targets 123,000 companies to be registered by year end.

E-voucher incentive from the government. According to the RMCD, one of the reasons for the delay in registration was due to the market perception that the software upgrade is too expensive to implement. In order to increase the take-up rate, the government, through SME Corporation Malaysia, has announced that it will provide an incentive of RM1,000 per qualified SME (Refer to table 1) in the form of e-vouchers. The government has allocated RM150m for the GST e-voucher scheme. This implies that the government is targeting approximately 150,000 (RM150m ÷ RM1,000) SMEs to register for the GST. However, response has been disappointing as only 1,321 applications were made. Of this, only 714 applicants have been approved by the RMCD.

Table 1: Summary of qualification requirement set by the authorities

Time is ticking. Datuk Subromaniam Tholasy, GST director from RMCD, has expressed his concerns over the delay in registrations. Datuk Subromaniam further elaborated that the SMEs may need at least three months to upgrade to the GST-compliant system which is slated for implementation on 1 st April 2015. The RMCD also reiterates that there will not be any leniency for late adopters. Recall that the deadline for mandatory registration is 31 st December 2014.

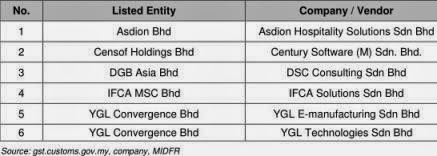

A sizeable market worth a potential RM1.7b. In general, a typical software upgrade would cost somewhere within the range of RM2,000 to RM10,000. Assuming a median software cost of RM6,000 and considering that approximately 285,000 companies have yet to register, software vendors can expect a sizeable order book of approximately RM1.7b to be booked either by 4QCY14 and/or 1QCY15. Our initial check on the official website of RMCD indicates that there are more than 100 authorized accounting software vendors that SMEs can choose from. From the list, we have identified six software vendors which are owned by five listed entities (Refer to Table 2).

Table 2: Potential listed entity beneficiaries

by MIDF