ECONPILE HOLDINGS BHD

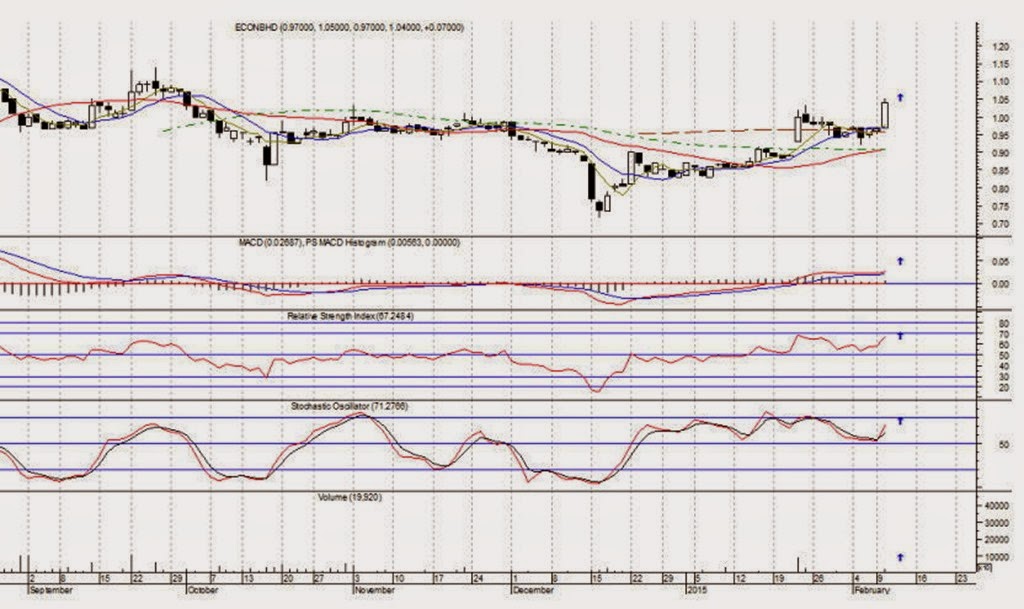

Last Price: RM1.04 +0.07 Support Level: RM0.97, RM0.92

Resistance Level: RM1.05, RM1.10, RM1.15, RM1.20, RM1.22, RM1.30

Entry Level: RM1.04 – 1.05

Technical Analysis

ECONBHD (5253) rebounded strongly from its intra-day low of 0.97 to close higher at 1.04 after hitting the intra-day high of 1.05. Technically, the chart of ECONBHD formed a bullish white candlestick with increasing volume, indicating strong buying interest came into the stock yesterday. It breaks out from the consolidation range forming a small saucer pattern breakout. MACD swung upward, indicating an increased in momentum to the upside and a buy signal. RSI (14) rose to 67.2 from 58.3, indicating the stock is turning bullish. Stochastic rose to 71.3 from 52.7, and made a golden-cross over the slow stochastic line, issuing a stochastic buy signal. The medium and long term trend of ECONBHD is up, and the short term trend is up with the 5-day SMA crossing above the 10-day SMA, issuing a buy signal, and a confirmed breakout above RM1.05 will see an upside target of RM1.10, follow by RM1.15, RM1.20, RM1.22 and RM1.30.

Since the short term trend is bullish, day traders with shorter time frame perspective may ride on the short term bullishness and buy on breakout level (RM1.05). Those with lower risk appetite should wait at the side-line and buy on the dip.

Price Objective

Short Term – target price at (RM1.10, RM1.15, RM1.20), stop loss (RM0.96)

Mid Term – target price at (RM1.22, RM1.30), stop loss (RM0.91)

by SJ Securities Sdn Bhd