EATECH’s positive signals above suggest a very strong weekly uptrend. SHORT-TERM BUY on dips for EATECH with very firm supports of MYR0.88 and MYR1.05 as well as clear upward target areas of MYR1.10, MYR1.33, MYR1.45 and MYR1.69. Stop-loss is at MYR0.86.

Stock Code: 5259 Bloomberg Code: EATECH MK Equity

EATECH Weekly Chart:

EATECH continued to surge firmly after we published our weekly technical report in April 2015. Since then, it surpassed all our target levels due to the strong upside momentum after having recently secured a new contract in Feb 2015. The contract was for the Engineering, Procurement, Construction, Installation and Commissioning (EPCIC) of a Floating Storage Offloading facility (FSO) for Full Field Development (FFD) project, North Malay Basin, valued at USD191.8m for 20 months.

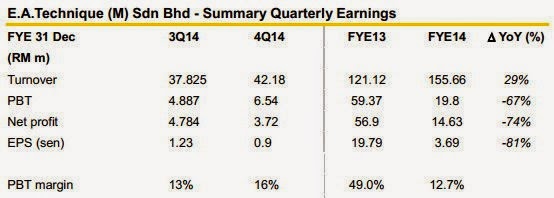

A check of the Bloomberg consensus reveals that no research house covers the stock. EATECH currently trades at a very high historical PER of 28.4x. Its price-to-book value ratio of 2.23 times indicates that its share price istrading at a steep premium to its book value.

E.A. Technique (M) Sdn Bhd (EATECH) owns and operates marine vessels focusing on marine transportation and offshore storage of oil and gas, and provision of port marine services. It also owns a shipyard involved in shipbuilding, ship repair and minor fabrication of steel structures.

by Maybank IB