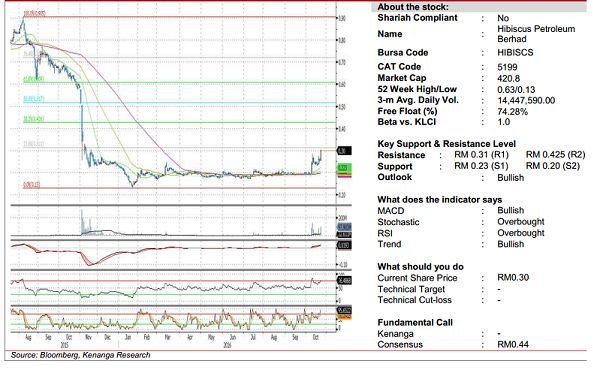

Stock Code: 5199 RM0.30

Yesterday, HIBISCS surged 4.5 sen (17.6%) to finish at RM0.30 on high volume (98.0m shares). Last Wednesday, the company announced that it will buy Shell’s 50% interest and operator-ship in the 2011 North Sabah Enhanced Oil Recovery production sharing contract for US$25.0m. From a charting perspective, HIBISCS' short to longer term trend is positive with the share price already broken out of its sideways range at RM0.22 earlier in the month. Coupled with the rising momentum indicators, we can expect the share price to be positively biased from here. Major resistances to take note includes RM0.31 (R1). Should this level be taken out next, HIBISCS would then have a clear path towards RM0.425 (R2) further up. Downside support levels are RM0.23 (S1) and RM0.20 (S2).

source: Kenanga Research – 25/10/16

HIBISCUS PETROLEUM BERHAD

The Company intend to establish as a junior independent Malaysian oil and gas E&P company with the sole focus on developing small oil and gas fields in the South Asia South East Asia and Oceania regions. The Company plan to achieve this by identifying and acquiring target company assets which participate in upstream oil and gas E&P activities. Upstream oil and gas activities consist of exploration development and production of oil and gas resources.