● Prime Minister Najib’s six-day official visit to China has taken “bilateral relations between Malaysia and China to a higher level, a new high.” PM Najib has witnessed the signing of 14 agreements worth RM144 bn.

● China has become Malaysia’s BFF. We expect more China inflows, especially with China’s aspiration of the “One Road, One Belt”. China’s keen interest in Malaysia is a positive as Malaysia needs China’s balance sheet to pump prime the economy.

● Positive for the construction sector—we have OUTPERFORM ratings on Gamuda and IJM Corp. We see investor interest in small-cap construction-related stocks such as Ann Joo, Ekovest, and Econpile.

● Foreign institutions were net sellers of Malaysian equities amounting to RM0.4 bn, while domestic institutions were net buyers (+RM0.9 bn).

China’s One Road, One Belt:

China is now Malaysia’s BFF

China has featured heavily in Malaysia’s FDIs with China emerging as Malaysia’s top foreign investor in 2015. Earlier flows from China into Malaysia include (1) CGN’s acquisition of Edra Power for RM10 bn; (2) China’s CRG winning the bid for 1MDB’s 60% stake in Bandar Malaysia for RM7.4 bn; (3) the 1,500-acre Malaysia-China Kuantan Industrial Park, (4) Melaka port; (5) the rescue of Perwaja Steel; (6) China stating its intentions to purchase Malaysia Government Securities, (7) China’s CRRC manufacturing centre in Batu Gajah, (8) China Railway had recently been awarded the contract to build the Gemas-JB double-track rail; (9) China’s stated interest in the KL- Singapore High Speed Raillink.

Prime Minister Najib’s six-day official visit to China has taken “bilateral relations between Malaysia and China to a higher level, a new high.” PM Najib has witnessed the signing of 14 agreements worth RM144 bn with the main ones being the following:

● China Construction Bank (CCB) was granted a banking licence (third in Malaysia after BoC and ICBC) by the Minister of Finance. With an initial paid-up capital of US$200 mn, CCB will be able to provide infrastructure financing.

● An EPC agreement between China Communications Construction Company (CCCC) and Malaysia Rail Link: Transport Minister Liow said China's EXIM Bank would provide RM55 bn in soft loans at competitive rates and a repayment period of 20 years.

● MOU for Investment, Development and Construction of Melaka Gateway Project (KAJ Development and Power China).

Clearly, China has become Malaysia’s BFF. We expect more China inflows in the future, especially with China’s aspiration of the “One Road, One Belt”. China’s keen interest in Malaysia is a positive for PM Najib as Malaysia needs China’s balance sheet to pump prime the

economy. Positive for the construction sector—we have OUTPERFORM ratings on Gamuda and IJM Corp. We see investor interest in small-cap construction-related stocks such Ann Joo,

Ekovest, and Econpile.

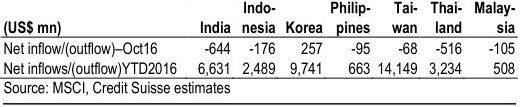

Foreign equity outflows in another quiet month Foreign institutions were net sellers of Malaysian equities amounting to RM0.4 bn while domestic institutions were net buyers (+RM0.9 bn).

Foreign institutions were net sellers in Oct 2016 (-RM0.4 bn)

Malaysia’s foreign flows vs other Emerging Asian markets

Domestic institutions were net buyers (+RM0.9 bn)

source: Credit Suisse – 03/11/16