Attractive warrant with step-down mechanism

COMMENTS

■ Sunway issued a circular with more details on the proposed bonus issue and free warrants. To recap, Sunway had proposed 4 bonus issue of shares for every 3 existing shares and 3 free warrants for every 10 existing shares. The above proposals were approved by Bursa on

24 July and EGM will be held on 30 August to secure shareholders’ approval.

■ Compared to ordinary free warrants, we opine that Sunway’s free warrants are attractive as the first-of-its-kind fixed annual step-down mechanism of RM0.07 will enhance the value of warrants.

■ For ordinary warrants, a dividend entitlement on the underlying mother share would reduce the value of the warrants. However, with the step-down mechanism (which is akin to a fixed adjustment of dividend payment to underlying), the value of warrant would be unaffected (if the quantum of step-down is equal to the dividend).

■ In the case of Sunway, given the annual step-down of RM0.07, the estimated value of the free warrant is RM0.62 (post-bonus issue adjustment) based on Binomial Option Pricing Model (see Figure #1), representing a premium of 34%. However, the estimated value of warrants could fetch as high as RM0.73 if based on our TP of RM5.04.

■ Note that the step-down of 7 sen is higher than our projected dividends for FY18 and FY19 at 4.6 sen and 4.9 sen (post bonus issue adjustment) per share, respectively.

■ The higher quantum of step-down compared to dividend projection could further enhance valuation of the warrants.

■ We gather that while Sunway has no immediate plan to utilize the proceeds (~RM1.15bn assuming full conversion) from the conversion of warrants. Hence, any proceeds raised will be used for future working capital or deleveraging.

RISKS

■ Prolonged downturn in property market;

■ Execution risk

FORECASTS

■ Unchanged

RATING

BUY, TP: RM5.04

■ Sunway remains our Top Pick within the sector as we believe it should be rerated and trade closer to its peers such as IJM and Gamuda (refer to Figure #2) given its diversified income stream and declassification from property sector. At a P/E of 13.9x as compared to peers, we opine that it represents a deep value stock with potential assets unlocking and growing healthcare business which are underappreciated.

VALUATION

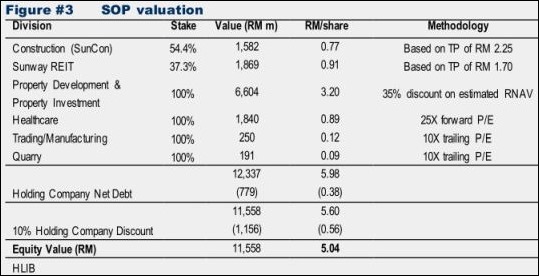

Our TP is unchanged at RM5.04 based on SOP derived valuation with a 10% holding discount (see Figure #3).

source: HLIB Research – 31/07/2017