Steel- Maintain MARKET WEIGHT. Maintain HOLD for Ann Joo Resources. Prefer deep-value stock – Choo Bee Metal Industries. Potential beneficiary of various highway projects – Prestar Resources.

Local steel prices rebounded in Jul 17, echoing China’s steel price movement driven by capacity cuts as well as expectations of increased local demand. We believe that the improvement in ASP should be sustainable moving into 4Q17 as we expect steel demand to improve on mega infrastructure projects. Hence, 2H17 earnings could surprise on the upside after an unexciting 2Q17. Maintain MARKET WEIGHT.

WHAT’S NEW

WHAT’S NEW • Steel prices rebounded in Jul 17. Based on the Ministry of International Trade and Industry (MITI) statistics, domestic steel bar prices for Jul 17 rebounded by 17.4% yoy and 7.8% mom to RM2,178/MT, mainly reflecting the surge in China steel prices. Although Jul 17 prices are still lower than 1Q17 prices (1Q17: RM2,233/MT), we believe that the mom surge will provide for a sector-wide earnings excitement. We also noticed that the price differential between local and China imported billets had widened by 2ppt in July, In Jun 17, China imported billets which were traded at a 20% premium which expanded to 23% in Jul 17.

• China’s steel production in Jun 17 at an all-time high. Chinese millers have increased output to an all-time high since Mar 17. China’s steel production was still high in May (- 0.7% mom, +2.5% yoy). We understand that Chinese millers continued to ramp up production as the industry is still reporting healthy margins.

• Expect strong earnings growth in 3Q17. Although 2Q17 is expected to have been unexciting (due to weak demand and soft steel prices), we believe that earnings in 3Q17 will surprise on the upside should ASP be sustainable. In addition, we expect steel demand to show a gradual recovery mainly starting from 3Q17 on the commencement of mega infrastructure projects such as MRT 2, LRT 3 and the ECRL.

ACTION

• Maintain MARKET WEIGHT. Despite a brighter sector outlook, we believe that the steel companies are already trading within a fair trading range, but prudent capital management could lift valuations. We like steel companies that have prudent capital management, particularly Ann Joo and Choo Bee which had dividend payout ratios of 45% and 43% respectively in their previous financial years. We also believe these companies could declare a bonus share issue ahead of changes to The Company Act 2016 which will abolish the concept of par value.

• Maintain HOLD for Ann Joo Resources (AJR MK/HOLD/RM3.11/Target: RM3.30). Although we have a HOLD recommendation, we believe that share price for Ann Joo could be lifted from effective capital management. Ann Joo has a dividend policy of up to a 60% dividend payout ratio subject to future capital requirement. In 2016, Ann Joo distributed 45% of its earnings to shareholders which translates into a dividend yield of 4.8%. Entry price: RM3.00

• Prefer deep-value stock – Choo Bee Metal Industries (CBEE MK/NOT RATED /RM1.97). Choo Bee could be a proxy to sustainable growth in the flat steel segment. We also like its prudent capital management as it has a 43% dividend payout ratio for 2016 which translated into dividend yield of 4.6%. It is also a net cash company with cash level representing 19% of its market cap. It is currently trades at 6.4x 12-months trailing PE.

• Maintain MARKET WEIGHT. Despite a brighter sector outlook, we believe that the steel companies are already trading within a fair trading range, but prudent capital management could lift valuations. We like steel companies that have prudent capital management, particularly Ann Joo and Choo Bee which had dividend payout ratios of 45% and 43% respectively in their previous financial years. We also believe these companies could declare a bonus share issue ahead of changes to The Company Act 2016 which will abolish the concept of par value.

• Maintain HOLD for Ann Joo Resources (AJR MK/HOLD/RM3.11/Target: RM3.30). Although we have a HOLD recommendation, we believe that share price for Ann Joo could be lifted from effective capital management. Ann Joo has a dividend policy of up to a 60% dividend payout ratio subject to future capital requirement. In 2016, Ann Joo distributed 45% of its earnings to shareholders which translates into a dividend yield of 4.8%. Entry price: RM3.00

• Prefer deep-value stock – Choo Bee Metal Industries (CBEE MK/NOT RATED /RM1.97). Choo Bee could be a proxy to sustainable growth in the flat steel segment. We also like its prudent capital management as it has a 43% dividend payout ratio for 2016 which translated into dividend yield of 4.6%. It is also a net cash company with cash level representing 19% of its market cap. It is currently trades at 6.4x 12-months trailing PE.

• Potential beneficiary of various highway projects – Prestar Resources Bhd (PRST MK/NOT RATED /RM1.25). Prestar could benefit from various highway projects where it has 50% market share in supplying guardrail for major highways in Malaysia. Currently, it is trading at 7.3x 12TTM PE and dividend yield of 1.6%. Traditionally, it has been rewarding shareholders with a 20% dividend payout ratio.

ESSENTIALS

• Local steel prices rebounded in Jul 17. According to MITI’s website, ASP for local steel bars rebounded by 17.4% yoy and 7.8% mom to RM2,178/MT. The strong rebound followed

the soft decline in Jun 17 prices (-2.5% mom) and is in sync with the surge in China steel prices which reached an all-time high since 2013. We also understand ASP for local flat steel products had also picked up in early-Aug 17, after flat growth in Jul 17. We believe that the increase in ASP should be sustainable moving into 2H17 as the price differential between local and China imported billets widened by 3ppt mom in Jul 17. In Jun 17, China imported billets which were traded at a 20% premium which expanded to 23% in Jul 17. The sustainaibility of local steel ASP will be supported by improved demand by 2H17, largely from various mega projects such as MRT2, LRT 3 as well as the east coast rail link (ECRL).

• China steel production at all time high. Steel production in China in the month of June recorded an all-time high 73.2m MT, up by 1.3% mom and 5.4% yoy. To recap, steel production jumped significantly due to reportedly healthy margins which encouraged Chinese millers to increase output. It is worth to note that China’s steel industry made a US$9.8b loss in 2015 but turned around in 2016 with a US$5.1b net profit. In addition, we also attribute the escalation in steel production in China to the closure of induction furnace mills (IF) in China. We gathered that the IF closures are expected to have a fundamental impact on the China steel industry as it could have resulted in a 60m-70m MT cut in production output as of end- Jun 17 (approximately 25-30% of China’s rebar production). Note that the demolition of IF mill is an add-on to China’s initial plan to reduce domestic steel production capacity by 100-150m MT within five years. Products of IF mills are highly criticised for not being environmental friendly (during production process); IF mills do not remove the impurities from scrap, which leads to the production of substandard steel products.

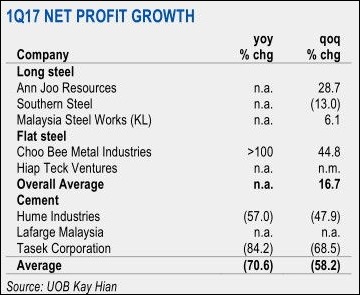

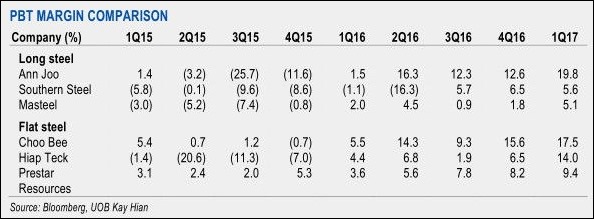

• Sluggish 2Q17 earnings but 3Q17 should see a positive surprise. We reiterate our views that for long steel products, we might see a milder earnings growth in 2Q17 due to softer domestic ASP and persistently weak demand for steel products. To recap, domestic steel bar prices dropped 2.5% mom and 2.3% yoy to RM2,020/MT in Jun 17 while steel bar ASP for 2Q17 dropped 7.1% qoq and 4.0% yoy to RM2,075/MT. However, earnings could surprise on the upside in 3Q17 given the strong rebound in steel prices coupled with a gradual improvement in steel demand. On the other hand, for flat steel products, earnings in 2Q17 could be sustained as prices of hot-rolled coil have fallen 13.9% qoq to Rmb3,223.10/tonne. To recap, average domestic ASP for flat steel increased 30.0% qoq to RM3,000/MT in 1Q17 and subsequently declined by 6.7% to RM2,800/MT in 2Q17.

• Prestar Resources as proxy to various highway projects. We recently met with flat steel producer, Prestar Resources Bhd. The company basically operates with two main divisions – a steel processing unit (ie coil centre and steel pipes) as well as a product manufacturing unit (ie material handling equipment and road furniture). We think that Prestar Resources could benefit from mega highway projects as it is the largest guardrail manufacturer in Malaysia with an estimated 50% market share. Prestar Resources also has a proven track record as it previously supplied guardrail for a few notable projects such as the Sepang F1 Race Track, Kesas Highway and East Coast Highway. The company does not have a dividend policy but traditionally has been rewarding shareholders with a 20% dividend payout ratio

source: UOBKayHian – 14/08/2017