■ Petronas recently released its activity outlook report, and the guidance for the volume of work in 2018-19F appears to have increased from the previous March guidance.

■ This will be positive for Malaysian O&G companies, which have likely passed the nadir of their earnings in either 2016 or 2017F.

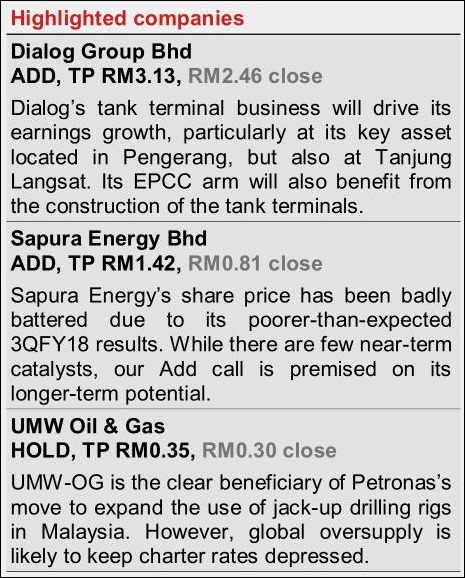

■ We recently added Dialog and Yinson to our coverage, our two top sector picks, both with Add calls, and also recently upgraded UMW-OG to a Hold, and SAPE to an Add.

■ Hence, we upgrade our sector rating to an Overweight, from Neutral previously.

IEA does not expect oil prices to hold at current levels…

Although the spot price of Brent crude breached the US$60/bbl barrier on the upside in late-October, fundamental demand-supply projections by the International Energy Agency suggest that prices should weaken sequentially in 1H18F, before rising again in 2H18F.

This is because supply growth from non-OPEC sources in 2018F is more than sufficient to meet global demand growth projections, resulting in a ‘call on OPEC crude’ that is actually below OPEC’s current production levels.

…but Petronas’s capex budget may be based on a higher oil price

In the “Petronas Activity Outlook 2018-2020” report that was recently issued in December 2017, Petronas said that it expected oil prices to hover around US$50-60/bbl. This view is unchanged from Petronas’s view in March 2017, when it issued the inaugural version of the same report. In any case, Petronas appears to have turned more positive on its projected capex for 2018F and beyond, suggesting that it may have based its budgeted capex on an oil price assumption that is higher than its US$45/bbl assumption for 2017F.

Outlook for jack-up (JU) drilling rigs has improved…

Between March and December 2017, Petronas raised its expected demand for JU rigs. This is positive for UMW-OG and Perisai, as we expect domestic demand to cover most, if not all, of their available JU rigs. However, we expect Petronas to continue to demand attractive rates, and perhaps pressure these local players to reduce their price offers.

…but does not translate into demand for tender drilling rigs (TDR)

In contrast, demand for TDRs has not moved much, and Petronas is forecasting that it will only need 2-3 TDRs for 2018-19F. SAPE has 15 TDRs in total. Petronas’s modest demand for TDRs means that SAPE will need to focus on securing foreign jobs to achieve our forward utilisation assumption of 50%. We expect the SAPE group to register core net losses for the next three forecast years, as drilling losses more than offset expected profits from the engineering and construction (E&C) and energy arms.

Outlook for E&C work has improved

The prospects for local fabricators appear to have improved, with Petronas now guiding for more wellhead platform fabrication jobs, even though central processing platform fabrication volumes are likely to remain low. More heavylift installation and offshore pipelay installation work is also expected. The outlook for hookup and commissioning and maintenance work has also improved, with more man-hours expected. The better prospects in E&C should benefit SAPE and other Malaysian players.

Number of Offshore Support Vessels (OSV) required has increased

In December, Petronas indicated that it will require more AHTS and fast crew boats in 2018-19F than previously guided in March. This is positive for local OSV players like Bumi Armada and ICON Offshore.

Top sector picks: Dialog (TP: RM3.13) and Yinson (TP: RM4.88)

Our top sector picks are Dialog and Yinson, as they both have a good track record in

execution and their business models have relatively low risk profiles. We also have an

Add on SAPE as the sharp sell-off has exposed longer-term value, and an Add on BAB

as its Kraken and Olombendo FPSOs are heading towards final acceptance.

source: CIMB Research – 15/12//2017