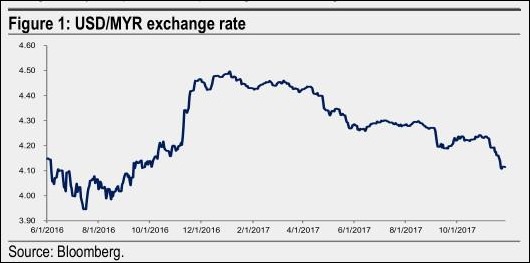

● CS' FX strategy team has raised USDMYR forecast to 4.0 in three months and 3.80 in 12 months (from 4.10 and 4.0 previously). RM has appreciated 8% vs the USD YTD and is currently at the strongest level so far this year.

● In our view, companies most materially affected would be (1) those with mismatch in USD-denominated revenue and cost, (2) companies with majority of profits derived from offshore operations, (3) companies with sizeable foreign currency denominated debt.

● Key beneficiaries of a stronger RM in our view are TNB, Air Asia and Astro. Meanwhile, our screen seems to suggest that there is a longer list of potential losers which include: telecommunication companies (Axiata, TM, TimeDotCom), rubber, petrochemical companies, Inari, IHH and plantation companies.

● The adverse impact of a stronger RM on corporate earnings could be among the key factors suppressing street's corporate earnings estimates (Malaysia is the only market in Asia with no 2017E EPS growth) despite the improving economic growth outlook.

We take a look at the possible winners and losers of a stronger RM vs USD.

Winners

● TNB - Tenaga’s USD-denominated debt as at 31 August 2017 amounted to RM6 bn (16% of total borrowings). Our rough estimates show that a 10% strengthening in MYR against USD should have an approximate 12% impact on earnings, all else constant. Nevertheless, we understand that TNB has hedged at least 50% of its foreign currency exposure up to 12 months, hence possibly reducing the quantum of the earnings impact.

● Air Asia - AirAsia has a significant portion of borrowings which is USD-denominated (RM8.4 bn or 86%) as at 30 June 2017. Bulk of its operating cost (fuel and maintenance) is also dominated in USD; although AirAsia has hedged 50% of its USD opex up to December 2017, the unhedged portion coupled with the expiry of these hedges beyond 2017 would have a positive impact on earnings. Assuming foreign-denominated cost is not hedged, a 5% appreciation in RM would lead to a 5% boost in net profit.

● Astro - The stronger RM is positive for Astro as its content cost is denominated in USD. We estimate that Astro’s bottom line in FY19E and FY20E will improve by 3.1% and 6.5%, respectively should the ringgit improve to RM3.80 (less impact in FY19E as Astro has hedged 80% of its annual USD exposure today).

Losers

● MY telcos - mobile: The stronger RM is unlikely to impact MY telco’s IDD business anymore, given that they are now pricing their services using the ‘cost plus’ method to avoid the pitfalls in 2016 (it became a loss-making business). That said, the scenario will likely be negative for Axiata, given that ~70% of its FY18E EBITDA is denominated in foreign currency. We estimate that if RM trades at RM3.80 vs USD, it would have an approximate

5%/15% impact on Axiata’s FY18E EBITDA/net profit, all else equal; earnings exposure to foreign business will be partially offset by some modest interest savings due to Axiata's sizeable USD debt. However, management could take pre-emptive steps (such as re-negotiate interconnect fees, reduce traffic in impacted areas) to mitigate the impact.

● MY telcos – fixed line: Within the fixed line space, both TM and Time Dotcom’s submarine cable business will be impacted if RM strengthens, given that the contracts are generally priced in USD. However, the impact is modest, based on our estimates given that if RM trades at RM3.80 vs USD, only 7-10% of TM and Time’s revenue will be impacted (~3% of EBITDA).

● Rubber companies such as Top Glove and Karex whose revenue is USD-denominated would be negatively impacted by a stronger MYR. We estimate a 10% strengthening in MYR will have a 25% earnings impact on Karex, ceteris paribus. Meanwhile, the same sensitivity on Top Glove will impact earnings by approximately 7%. Nevertheless, we highlight that the exporters typically adjust selling prices to reflect any adverse forex movements, albeit with a slight 1-2 months’ time lag.

● Petrochemical companies tend to lose out in a strong RM environment as revenue is denominated in USD (product prices linked to international prices). Though majority of its costs are in USD (feedstock, energy costs, etc), some portions of its costs are in RM. We estimate 8% and 12% negative earnings impact for every 5% appreciation in RM for PCHEM and LCT, respectively.

● Plantation – Plantation companies tend to be adversely affected as stronger RM would lead to lower revenues (palm oil traded in USD) while the bulk of cost is denominated in RM.

● Inari: A stronger RM is negative for Inari as it bills its client in USD. We estimate that there could be 8-10% downside to our net profit estimates in FY19-20E assuming USD-RM at RM3.80.

● IHH - IHH Healthcare’s growth would be negatively impacted in the scenario of stronger RM as it generates >80% of total core revenues outside of Malaysia. If the currency appreciated to RM3.80 relative to USD in FY18, revenue and EBITDA could be affected by ~4%-5%, everything else equal.

source: Credit Suisse – 26/11/2017